Amul is the world’s largest producer of dairy products based in Gujarat, India, founded in 1946 by Verghese Kurian, also known as the father of the white revolution in India. Headquartered in Anand, Gujarat.

Apex Organisation Of The Diary Cooperative Of Gujarat Also Know As Amul is the most recognized and iconic brand in India.

Let us some more fundamental about Amul before learning the SWOT Analysis of Amul

Content Outline

Overview Of Amul

| Company Name | Amul |

|---|---|

| Year Founded | 1946 |

| CEO | R.S Sodhi |

| Headquarters | Gujarat, India |

| Total No: Of Members | 18 District Co-operative Milk Producers Union |

| Company Type | Private |

| Area Served | India |

| Number Of Employees | 3.6 Million ( Including Milk Producers ) |

| Total Sales Turnover ( 2019-20) | Rs 38,550 Crores ( US $5.1 Billion ) |

Amul was incorporated to protect the interests of consumers and milk producers in India By Gujarat Cooperative Milk Marketing Federation Limited ( GCMMFL ).

Note: GCMMFL Stands for Gujarat Co-operative Milk Marketing Federation Ltd

Amul Stands For Anand Milk Union Limited is also known for starting the white revolution, encouraging local milk farmers to dream. This is what made them the largest producer of milk products.

It Operates through 61 Offices, 10,000+ Dealers, and 10+ Lakh Retailers which is one of the largest networks in India after railways which has over 20+ employees. its products range from milk, cheese, butter, milk powders, beverages, ghee, ice cream, and other milk products.

Amul has been awarded over 10+ awards for excellence in marketing and quality

| No: Of Village Societies | 18,600 |

|---|---|

| Total Milk handling capacity per day | 35 Million litres daily |

| Milk Collection ( Daily Average As Of 2018-19 ) | 23 Million litres daily |

| Cattlefeed Manufacturing Capacity | 9200 MTs Per Day |

| Sales Turnover ( 2019 - 20 ) | Rs 38,550 Crores |

Did You Know?

A movie named Manthan was released in 1976 which is based on Amul’s white revolution. Over 5 lakh farmers financed it by contributing Rs 2 each.

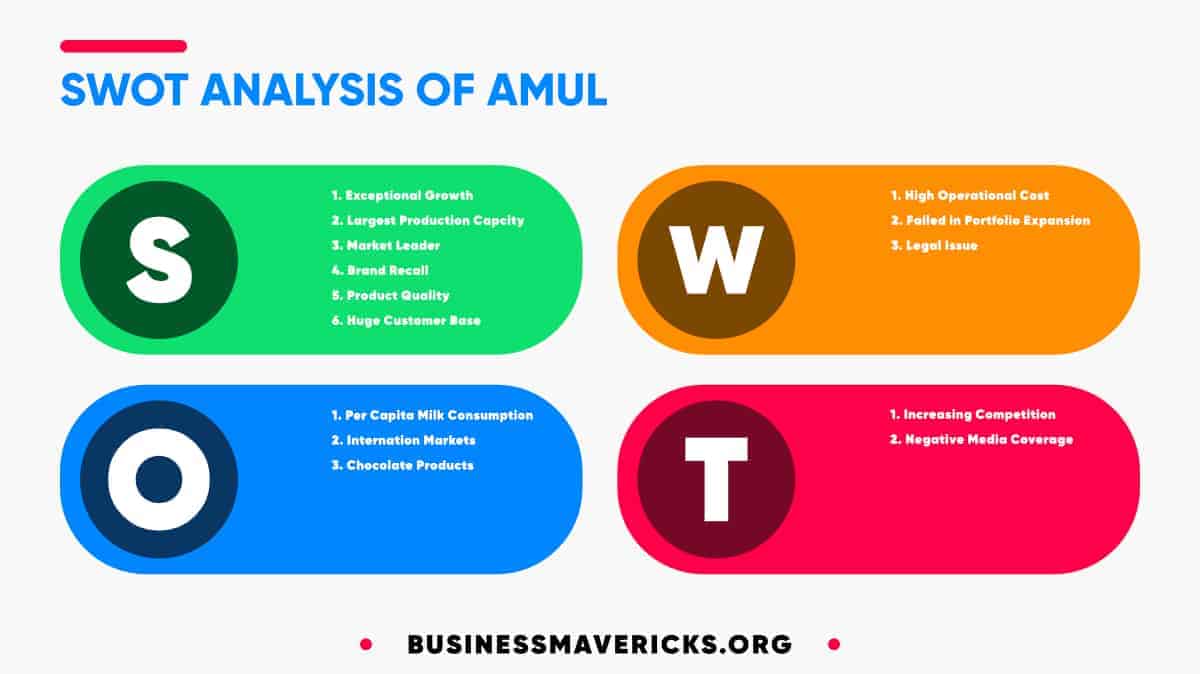

SWOT Analysis Of Amul

SWOT Analysis of Amul discusses the company’s strengths, weaknesses, figuring out how the company is planning to expand its businesses, growth strategies which we call opportunities and threats. As one of the largest dairy companies in India, it has several strengths, weaknesses, opportunities, and threats.

S Stands For Strengths

- Exceptional Growth – Amul has witnessed outstanding growth in the past few years. Amul has adaptive and revolutionary tools as it has done for decades. India has placed many investments in its dairy industry, and the company has sustained its position.

- Large Production Capacity – Amul is operated by the GCMMF, a cooperative body that produces over 20 to 30 million liters of milk each day. Amul’s production capacity is the largest among all others in the world.

- Market Leader – Amul has captured a huge market share in India because of its well-organized ice cream sector, with over 1/3rd of its market share and counting. Similarly, Amul’s other products are also expected to grow in the near future.

- Brand Recall and Equity – Amul became the most favorite brand for many Indians because of its genius marketing campaign called the Amul baby campaign, which helped to create a path for Amul’s brand to what it is today, especially when it comes to brand recall and equity. there are only a few brands that created this type of image among the people

- Best Quality – Amul is trusted by millions of people around the world for its high-quality products. Amul has maintained its operation with fair transparency for decades, which helps create a good relationship with the government and the health department. The estimate from such entities over its products has only added to its credibility and customer retention.

- Huge Customer Base – Amul has the amazing quality of transforming the urban demographic and reaching the rural areas. This allows it to have unique leverage over its competition as it expands its consumer base and maintains a presence in every corner of the country.

W Stands For Weakness

1. High Operational Cost: Amul has a high operational cost due to its massive size and complex structure. This can become problematic for the company if the company experiences a fall in demand.

The company also heavily depends on the dairy unions and communities for its supply of milk. As the needs of the dairy community are changing, with them demanding higher prices for their produce.

These issues can add up to the operational cost of the company and lower its profit margins.

2. Lack of Success in Portfolio Expansion: Amul has expanded its product portfolio to add butter, ghee, buttermilk, flavored milk, ice cream, chocolates, cheese, creams, sweets, and more.

However, not every product of Amul within its portfolio has tasted the same amount of success.

For instance, Amul’s chocolates have not been able to replicate the success of its ice cream brands. Amul chocolates have a tiny market share in the chocolates, sweets, and confectionery market in India.

3. Legal Issues: The company has faced legal issues in the recent past wherein Amul chose to advertise its products while disparaging the brand and products of its rivals. This led to Hindustan Unilever filing a lawsuit against Amul in the Bombay High Court.

In 2017, The Bombay High Court passed a verdict in favor of Hindustan Unilever. This caused the company a lot of embarrassment and also contributed to defaming the company’s public image.

O Stands For Opportunities

- Per Capita Milk Consumption – Amul can increase its per capita milk consumption which is generally 97 liters per year, much lower than that of countries like the USA or the EU. The demand for milk products continues to grow, and Amul has enough resources to capitalize on this demand.

- International Markets – Amul has the capacity to explore its reach in the international markets. It can access more Asian markets from neighboring countries to other regions and operate accordingly. Its international exports will increase its margins and turnover rapidly.

- Chocolate Production – Amul can invest generously in its chocolate production and thrive in the chocolate selling business. With adequate advertising, it can become its greatest

T Stands For Threats

- Increasing Competition – Amul increasingly faces fierce competition in the Ice Cream sector. More and more companies and brands, both local and foreign, are invading its markets and overtaking its sales. Competitors like Kwality Walls, Mother Dairy, Baskin Robbins, London dairy, and Havmor are a few names that directly threaten its business.

- Negative Media Coverage – Negative media coverage has not been beneficial for Amul’s operations. It has affected its sales and forced them to issue statements garnering unwanted media attention.

SWOT Analysis Of Amul Key Takeaways:

The SWOT analysis of Amul highlights where the brand currently stands and its threats in this era. Following are a few suggestions for Amul that were recommended after this detailed analysis:

- Focusing on the south Indian market because Amul’s market share is less than brands like Hatsun, heritage, and Aavin.

- More campaigns are to be produced to overcome the competition.