Life Insurance Corporation of India or LIC as it is popularly known is a government-owned insurance and investment company. Headquartered in Mumbai, LIC is considered the largest insurance provider in India, with estimated assets of USD 240 billion. LIC’s total life insurance fund is estimated at USD 143 billion and the company continues to sell policies worth millions every year.

Let us look into the Overview of Life Insurance Corporation Of India ( LIC ) and then we can move on to the SWOT Analysis of LIC ( Life Insurance Corporation Of India ).

Content Outline

Overview Of LIC ( Life Insurance Corporation Of India )

Life Insurance Corporation of India ( LIC ) is an Indian statutory insurance and investment company. It is under the Ministry of Finance, Government of India.

Life Insurance Corporation of India was established on September 1, 1956, when the Indian Parliament passed the Life Insurance of India Act, which nationalized the insurance industry in India. More than 245 insurance companies and provident funds were merged to form the state-owned Life Insurance Corporation of India.

As of 2019, the Life Insurance Corporation of India had a life insurance fund of Rs 28.3 trillion. The total value of policies sold in 2018-19 is Rs 21.4 million. The Life Insurance Corporation of India settled 26 million claims in 2018-19. It has 290 million policyholders.

Also, Read BCG Matrix Of Apple in a Simplified Way.

SWOT Analysis Of LIC ( Life Of Corporation Of India )

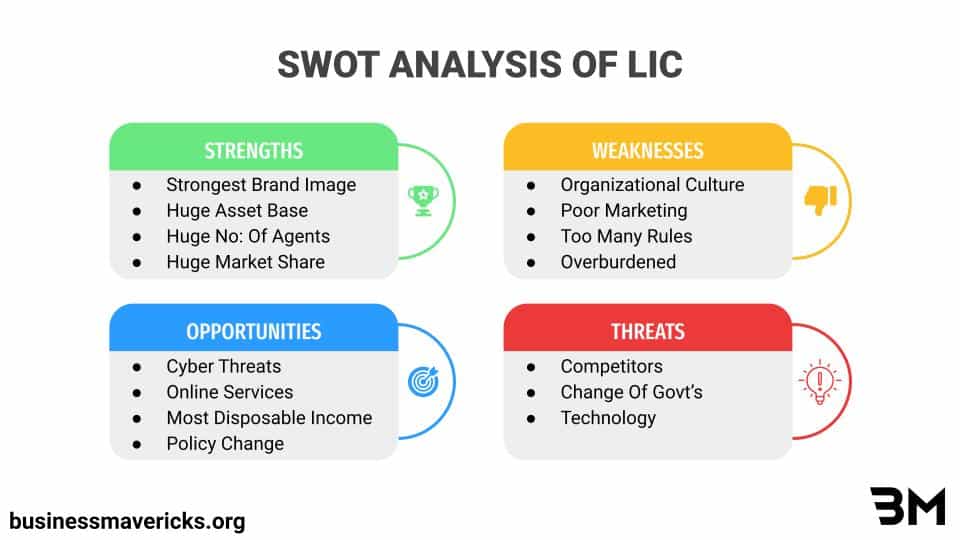

The SWOT Analysis of LIC ( Life Of Corporation Of India ) includes its strengths, weaknesses, opportunities, and threats. And in this reading of the SWOT Analysis of LIC ( Life Of Corporation Of India ), we will examine this beauty and wellness company in terms of its internal and external factors.

S Stands For Strengths ( Internal Factor )

- India’s largest insurance company: LIC currently operates across India with 2048 fully computerized branches, 8 zonal offices, about 113 divisional offices, 2,048 branch offices and 1381 satellite offices and corporate offices. The entire country is divided into 54 customer zones and 25 service centres in various Indian cities and towns. Currently, LIC has 1,337,064 individual agents, 242 corporate agents, 89 referral agents, 98 brokers and 42 banks for selling life insurance to the general public.

- Brand Image: LIC has a strong brand image in India. Its tagline Yogakshemam Mahamyaham, which means welfare for all, is widely known. The Economic Time Brand Equity Survey of 2015 voted LIC as the most trusted insurance provider in India.

- Asset base: LIC has huge assets of around USD 150 billion and is also India’s largest investor, giving it enormous power in India’s financial sector.

- Network of agents: LIC has 1,337,064 individual agents, 242 corporate agents, 89 referral agents, 98 brokers and 42 banks across India, covering every corner of the country.

- Strong Employees: LIC has over 1,15,000 employees across India.

- Subsidiaries: LIC has strong subsidiaries like LIC Housing Finance Limited, LIC Cards Services Limited, LIC Nomura Mutual Fund, LIC (Nepal) Ltd, LIC (Lanka) Ltd, LIC(International), BSC(C).

W Stands For Weaknesses ( Internal Factor )

- Organisational Culture: LIC is strongly tied to the government and thus follows a very loose and slow work culture. This is a weakness compared to modern private insurance companies that are strategically savvy.

- Poor Advertising Strategy: compared to the private providers, LIC does not spend too much money on advertising, which is reflected in the quality of the ads it publishes.

- Too Many Restrictions: Since LIC is a government-owned company, it is subject to many restrictions and there are always bureaucratic challenges. This makes decision making at LIC slow.

- Overburdened: LIC has a large number of staff and most of them work in their own offices. Paying their salaries and managing the issues is often a big challenge for the company.

O Stands For Opportunities ( External Factor )

- Cyber Threats: there are many cases of information threats and breaches of security systems. At a time when cybersecurity is a threat, insurance policies against this threat can prove to be a great opportunity.

- Online Services: with the growth of online services, people have started looking more into options like insurance and also awareness about it is now higher than before. This provides an opportunity for providers like LIC, who are labour-intensive, to reduce costs by replacing people with technology.

- Shift From Protection To Prevention: There is a general trend shift from protection to prevention, which is an indication for insurance companies to now focus on risk prevention rather than risk mitigation measures.

- More Disposable Income: Insurance is now seen as a form of investment rather than just protection. By taking advantage of this new approach, insurance companies can develop new products.

T Stands For Threats ( External Factor )

- Competition: With the privatisation of insurance, LIC has lost its old lustre and now faces stiff competition from private insurance companies that have brought more lustre to the industry.

- Change of Governments: With every new government, fiscal and monetary policies change, so strategies have to be revised accordingly. This brings in a lot of hassles.

- Technology: Nowadays, most financial service providers are making technology an integral part of their business through online banking and online financial brokerage services. However, the LIC still has a lot to do to keep up with technology.

SWOT Analysis Of LIC ( Life Insurance Corporation Of India ) Key Takeaways

The SWOT Analysis of LIC ( Life Insurance Corporation Of India ) highlights where the brand currently stands and its threats in this era. Following the detailed SWOT Analysis of LIC ( Life Corporation Of India ) Here are a Few Important Key Points.

- Very Strong Brand Image

- Strong Network of Agents

- Huge Number of Insurance Holders

Suggestions:

Following the detailed SWOT Analysis of LIC ( Life Insurance Corporation Of India ), we have a few suggestions from Business Mavericks:

- LIC Needs to Reduce its workforce to increase its profit margin as it already pays commission to its agents.

Life Insurance Corporation Of India ( LIC ) STP & USP

- Segment: Personal and Group Insurance

- Target Group: Urban and Rural Investors

- Positioning: Complete Insurance and financial solutions

LIC ( Life Insurance Corporation Of India ) USP

LIC ( Life Insurance Corporation Of India ) is India’s Largest Life Insurance Company.

LIC ( Life Insurance Corporation Of India ) IPO

Finance Minister Nirmala Sitharaman announced a proposal to conduct an IPO of LIC in the Union Budget 2021. The IPO is expected to take place in FY22. The Government of India will remain the majority shareholder even after the IPO. Ten per cent of the shares will be allotted to existing LIC policyholders. In 2021, the Indian government had proposed to significantly increase the authorised capital of Life Insurance Corporation of India (LIC) to INR250 billion ($3.4 billion) to facilitate the IPO scheduled for the next fiscal year, which begins on April 1.